Recapping a Wave of 2021 Collateral Program Changes

By David Messina, Managing Director, Credit and Collateral Analytics and Modeling

Season’s greetings to all the banks, credit unions, insurance companies, and CDFIs and that make up our extraordinary and diverse network of member institutions. As 2021 draws to a close, the Credit and Collateral Risk Management team at FHLBank San Francisco would like to take this opportunity to highlight some important changes that went into effect over the course of the past year that allowed our members even greater flexibility in accessing the Bank’s suite of secured credit products.

Securities Margins for Non-Depository Members

Securities Margins for Non-Depository Members

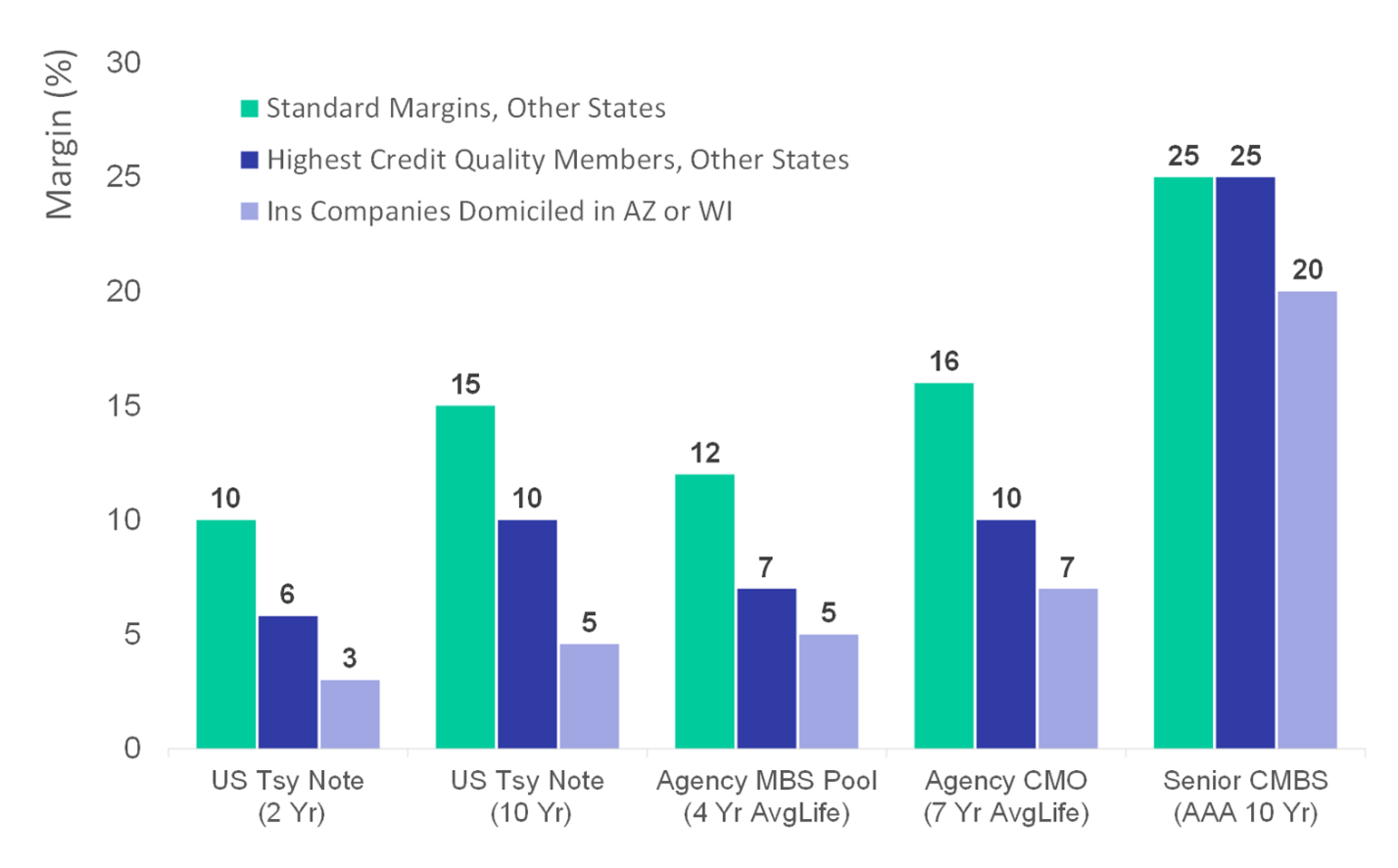

Beginning in Q3 2021, the Bank made two refinements to the margins (or haircuts) on securities collateral pledged by insurance companies, non-depository CDFIs, and non-member housing associates.

First, by eliminating the adjustments to the effective duration on pledged securities collateral, the Bank was able to lower its overall haircuts while maintaining its existing collateral risk appetite. This was made possible through implementation of a new quarterly securities collateral stress test, which can dynamically adjust margins for risks specific to individual counterparties as well as various securities collateral types.

Using a stress test approach for collateral, similar to a historical VAR analysis, allows the Bank greater precision in targeting a specific risk tolerance based on simulated economic stress or market value decline risk over a predefined holding period. Some securities, especially those with high interest rate sensitivity, may still receive a margin adjustment as a result of the stress test. However, the adjustments generally impact significantly fewer securities and by a much smaller amount as compared to the previous process. In the future, the Bank hopes to provide greater transparency to its collateral margins by posting analytics on our Member Portal that members can use to assess the results of the stress test on their institution’s quarterly pledged securities positions.

Second, the Bank reduced its expected liquidation holding period assumption for insurance company members domiciled in states that have passed laws that exempt FHLBanks from the automatic stay in the event of an insurance company being placed into receivership. The reduced liquidation holding period gives the Bank greater flexibility in lowering its base margins as supported by the quarterly stress test analysis. The margins for these select insurance companies now align much more closely to those associated with securities and mortgage loans pledged by depository institutions, such as banks and credit unions. Our insurance company members domiciled in Arizona and Wisconsin should experience the benefit of these changes.

Comparison of Insurance Company Margins for Commonly Pledged Security Types

Loans Held for Sale

In Q3 2021, the Bank revised its pledged collateral program for loans classified as held for sale (LHFS). LHFS typically applies to loans originated under wholesale funding agreements with the intent to sell to either one of the GSEs (e.g., Fannie Mae or Freddie Mac) or into secondary markets under a private label securitization (available to depository members only). Under the updated program, the Bank expanded eligibility to include both multifamily and single-family loans. Members eligible under the updated LHFS collateral guidelines include all depository institutions and highly rated insurance companies, CDFIs, and non-member housing associates that the Bank determines to have expertise in wholesale mortgage funding markets. Institutions that carry LHFS on their balance sheet are encouraged to contact your relationship manager to find out more about how the Bank can support your warehouse lending programs.

eNotes

Technology and innovation are reshaping many aspects of the housing industry, especially in the tech-focused areas of the Bank’s district. Earlier this year, the Bank began accepting mortgage eNotes as an eligible form of mortgage loan collateral and has become a leader and proponent for the future of mortgage finance by rolling out its eNotes program to all members.

eNotes include promissory notes that have been created, signed, and stored electronically rather than in physical form, i.e., a traditional paper document with a “wet” ink signature. All eNote copies are stored electronically in an eVault that is supported by the Bank’s eNote custodian, DocMagic. Members pledging eNotes under the Bank’s criteria receive similar borrowing capacity as those pledging under the traditional loan collateral programs.

Members getting ready to begin pledging mortgage eNotes can consult our Electronic Promissory Notes (eNotes) Collateral Acceptance Requirements and Guidelines. Questions regarding the setup and delivery of eNotes to the Bank should be directed to your relationship manager or the collateral operations support team.

Summing Up

As uncertainty surrounding both the pace of the Federal Reserve’s Quantitative Easing program winddown and path of the COVID-19 pandemic continues, it’s more important than ever before to have a trusted partner to help you manage the short-term liquidity needs and long-term strategic funding goals of your institution. The Bank is committed to supporting and strengthening your business franchise and will continue to update our collateral programs and risk management practices to meet the evolving needs of our unique membership base.

We thank you for your continued business, and, on behalf of the entire Credit and Collateral Risk management team, I want to wish everyone a very safe and prosperous 2022.

December 2021 | FHLBank San Francisco