FHLBank San Francisco Welcomes Three New Members

During the first half of 2023, the Bank was delighted to welcome three new members, including:

Compass Community Credit Union: Headquartered in Eureka, California with more than $175 million in assets, Compass Community Credit Union serves about 6,400 members in Humboldt, Del Norte, and Trinity counties. For over 72 years, Compass Community Credit Union has maintained an unwavering commitment to its members and proudly continues providing the highest level of dedication, care, and support. For more information, visit compassccu.org.

Los Angeles Federal Credit Union (LAFCU): Founded in 1936 during the Great Depression when 12 Los Angeles City employees pooled their resources of $60 to form a credit union, today LAFCU has grown to $1.2 billion in assets serving 73,000 members in the Greater Los Angeles Metropolitan counties of Los Angeles, Orange, Venture, Riverside, and San Bernardino. Learn more at www.lafcu.org.

Santa Ana Federal Credit Union: Established as a not-for-profit in 1950, Santa Ana Federal Credit Union started out by providing financial services to the employees of the City of Santa Ana, California. Now, 70 years later, the credit union proudly serves more than 6,000 members in Santa Ana and has over $74.5 million in assets. SAFCU continues to offer its members a wide range of free or low-cost financial services to take care of day-to-day finances and build a solid financial future. Learn more at www.safcu.org.

FHLBank San Francisco is a member-driven cooperative wholesale bank that adds value to a member financial institution’s enterprise by connecting them to the global capital markets and delivering a ready supply of low-cost liquidity and essential financial tools and expertise.

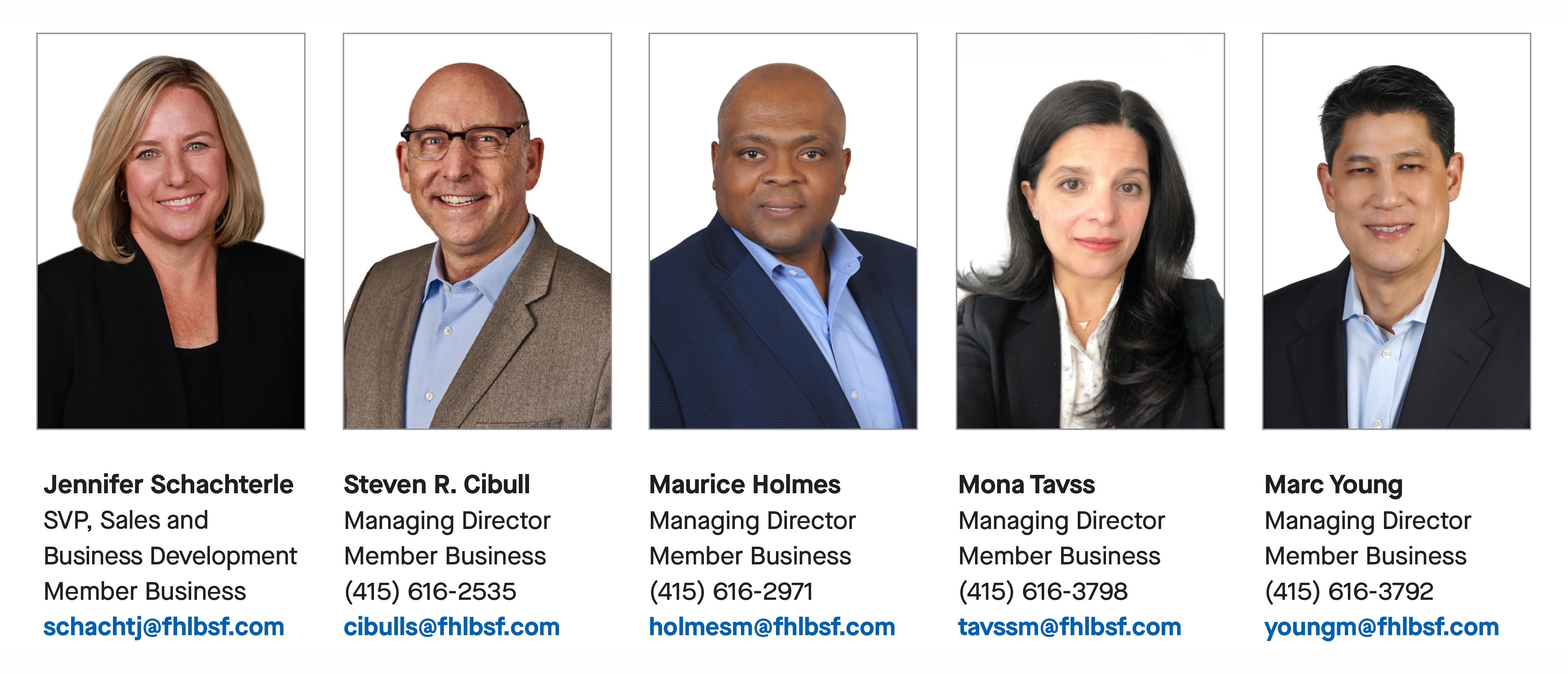

Contact FHLBank San Francisco's Relationship Managers

As a strategic partner, FHLBank San Francisco helps its members execute on financial strategies, achieve specific business objectives, and meet the diverse and ever-changing credit needs of customers and communities.

The products, services, tools, and resources we provide to our members promote homeownership, expand access to quality affordable housing, boost economic development, seed or sustain small businesses, and revitalize communities.

FHLBank San Francisco welcomes applications for membership from institutions that are:

- Federally insured commercial banks, savings institutions, and industrial loan companies

- Credit unions that are Federally insured, privately insured and state-chartered, or certified by the Community Development Financial Institutions Fund of the U.S. Department of the Treasury (CDFI Fund)

- Community development financial institutions certified by the CDFI Fund

- Insurance companies (captive insurance companies excluded)

Prospective members can email us at membership@fhlbsf.com to start the application process.