Bank Offers Safekeeping of Securities

by Robert Kim, security services managing director of operations

As a service to its members, FHLBank San Francisco can provide custody safekeeping of securities.

As a service to its members, FHLBank San Francisco can provide custody safekeeping of securities.

What kind of custody/safekeeping securities services does FHLBank San Francisco offer?

Our Securities Services team within Operations provides trade settlement, safekeeping, collection of income, processing of corporate actions, and general recordkeeping/reporting of a member's marketable securities held at FHLBank San Francisco. Eligible securities held at the Bank may be pledged as collateral to be applied towards the borrowing capacity of our members.

What is the difference between Federal Reserve Bank (FRB) and DTC eligible securities?

Several factors influence whether a security is settled through Fedwire or DTC, including security type, market practices, and issuer’s choice.

Fed eligible securities are typically securities issued through the Federal Reserve Banks’ Fedwire Securities Service. Clearing, settlement, and safekeeping of these securities happens using the Fedwire Securities Services and securities are held at our custodian, Citibank, with the FRB in a designated segregated account for each member.

- Typically, U.S. Treasury securities and many securities issued by federal government agencies and government sponsored enterprises including some international organizations are Fedwire eligible.

- For more information on general types of securities, visit the Federal Reserve website.

DTC eligible securities are securities that are freely tradeable pursuant to U.S. securities law and are held and serviced at DTC. The issuer must confirm DTC eligibility prior to issuance. These are typically non-FRB eligible securities.

- This includes but is not limited to equities, corporate debt/notes, municipal bonds, government securities, asset-backed securities, collateralized mortgage obligations, equity and debt derivatives, variable-rate demand obligations, and money market instruments.

- For more information on general types of securities visit the Depository Trust and Clearing Corporation website.

A prospectus or offering documents provide important information about the security issued that will typically include settlement information as well.

Should members transfer securities to FRB to use the discount window or the Bank Term Funding Program (BTFP)?

To transfer fed eligible securities from your custodial account at the Bank to the FRB Discount Window and the BTFP requires the following:

- Account is set up at the federal reserve (please confirm with the Bank)

- Broker Code is set up with the Bank’s custodian. If you have not previously sent securities to the Bank, please request a new broker code for the delivery of your fed eligible securities to the Bank.

- One time Broker Code needs to be set up at Bank for both or one of the discount window and/or BTFP.

- It could take up to five business days to set the broker code instruction up with the Bank’s custodian Citibank.

- Requests should be from an authorized individual listing your ABA and sub account number at the Federal Reserve (usually U102 for discount window or U101 for BTFP, however please confirm with the Bank)

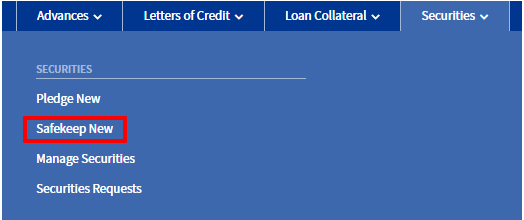

- On the Member Portal select “Securities” and then click “Manage Securities”

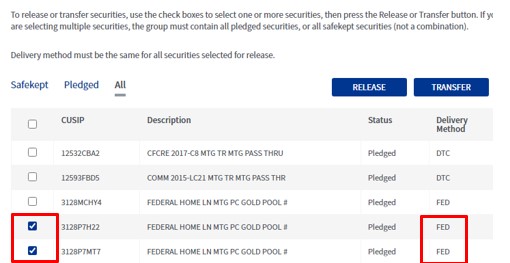

Next, select the checkbox for any FED delivery method securities you would like to transfer:

- Select “RELEASE”

- Enter instructions on the “Release Securities” screen

- Transaction Code = Standard

- Settlement Type = Free

- Settlement Date = Date you would like to transfer the securities

- Delivery Instructions

- Fed

- Clearing Agent’s Fed Wire Address

- BANK NAME/SUB ACCOUNT (i.e., U102 or U101)

- ABA Number

- The FRB E-Payment Routing Directory is a good source to find the ABA and Bank Name with the FRB.

- Remember to enter the BANK NAME/SUB ACCOUNT all in capital letters to reduce any delays in processing.

At this time our custodian is unable to send DTC eligible securities not issued and settled through the Federal Reserve to be pledged for use in the discount window or BTFP. We’re working with our custodian to accommodate this functionality in the future.

Whether the need is for FRB and or DTC securities, the Bank is prepared to help our members safeguard securities.

For any questions or assistance please reach out to the securities team at securityservices@fhlbsf.com or to your relationship manager for more information.