FHLBank San Francisco Welcomes Four New Members

In the first half of 2022, the Federal Home Loan Bank San Francisco was delighted to welcome four new members:

Lexicon Bank, Las Vegas, Nevada: Founded in 2019, Lexicon Bank provides private, personal, comprehensive banking services to business and personal banking customers, placing an emphasis on creating and nurturing a long-term relationship. By providing personalized services to all customers, Lexicon Bank helps to foster Southern Nevada’s economy and community – ultimately helping to grow the Las Vegas local business economy.

Safe 1 Credit Union, Bakersfield, California: In 1952, a small group of dedicated and concerned state employees from Union #35 met for the purpose of forming a financial cooperative for co-workers and their families. From these very humble beginnings, Safe 1 Credit Union was founded and formed. Providing savings and checking accounts to consumer loans, home loans, credit cards, as well as the latest in digital banking, Safe 1 serves the citizens of Kern, Kings, Tulare and Fresno Counties in California.

Schools Federal Credit Union, Torrance, California: In 1939, a group of employees at Los Angeles City School District, now known as Los Angeles Unified School District (LAUSD), decided to form a financial cooperative to assist those within its community. Their main objective, which remains true to the present day, is to provide its members with options geared to help them save and earn money. Schools Federal Credit Union now has nearly 15,000 members and primarily serves the communities around LAUSD and Los Angeles Community College District.

Valley First Credit Union, Modesto, California: Founded in 1949, Valley First Credit Union provides quality financial services to the growing and diverse communities of Calaveras, Fresno, Kings, Madera, Mariposa, Merced, San Joaquin, Stanislaus, Tulare, and Tuolumne Counties in California. Incorporating a credit union philosophy of “People Helping People,” Valley First Credit Union is a not-for-profit financial cooperative that gives money back to its members in the form of higher dividend rates on savings and lower interest rates on loans.

As a member-driven cooperative wholesale bank, FHLBank San Francisco adds value to a member financial institution’s enterprise by connecting them to the global capital markets and delivering a ready supply of low-cost liquidity and essential financial tools and expertise.

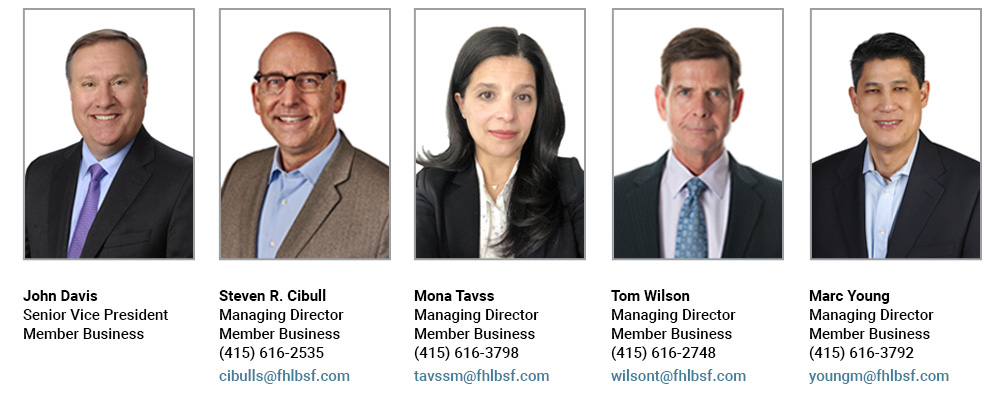

Contact FHLBank San Francisco’s Relationship Managers

As a strategic partner, FHLBank San Francisco helps its members execute on financial strategies, achieve specific business objectives, and meet the diverse and ever-changing credit needs of customers and communities.

The products, services, tools, and resources we provide to our members promote homeownership, expand access to quality affordable housing, boost economic development, seed or sustain small businesses, and revitalize communities.

FHLBank San Francisco welcomes applications for membership from institutions that are:

- Federally insured commercial banks, savings institutions, and industrial loan companies

- Credit unions that are Federally insured, privately insured and state-chartered, or certified by the Community Development Financial Institutions Fund of the U.S. Department of the Treasury (CDFI Fund)

- Community development financial institutions certified by the CDFI Fund

- Insurance companies (captive insurance companies excluded)

Prospective members can email us at membership@fhlbsf.com to start the application process.