2022: A Year of Change for Capital Markets

By Matt Johnson, Senior Director, Capital Markets and Analysis

The Bank maintained good access to the capital markets throughout 2022.

Beginning in May 2022, the Federal Reserve began raising short-term rates and embarked on quantitative tightening (QT), reducing its holdings of U.S. Treasuries and Agency MBS.

Also, in the second quarter, due to elevated tax receipt revenue, the Treasury Department reduced its weekly issuance of T-Bills by $60 billion per week, causing very short Treasury maturities to trade extremely rich (low yield). With the uncertainty around the pace of monetary tightening, and the resulting increase in volatility in longer maturities, investors who could not access the Fed’s Reverse Repo facility (RRP) program invested in short-dated Treasury Bills (T-Bills).

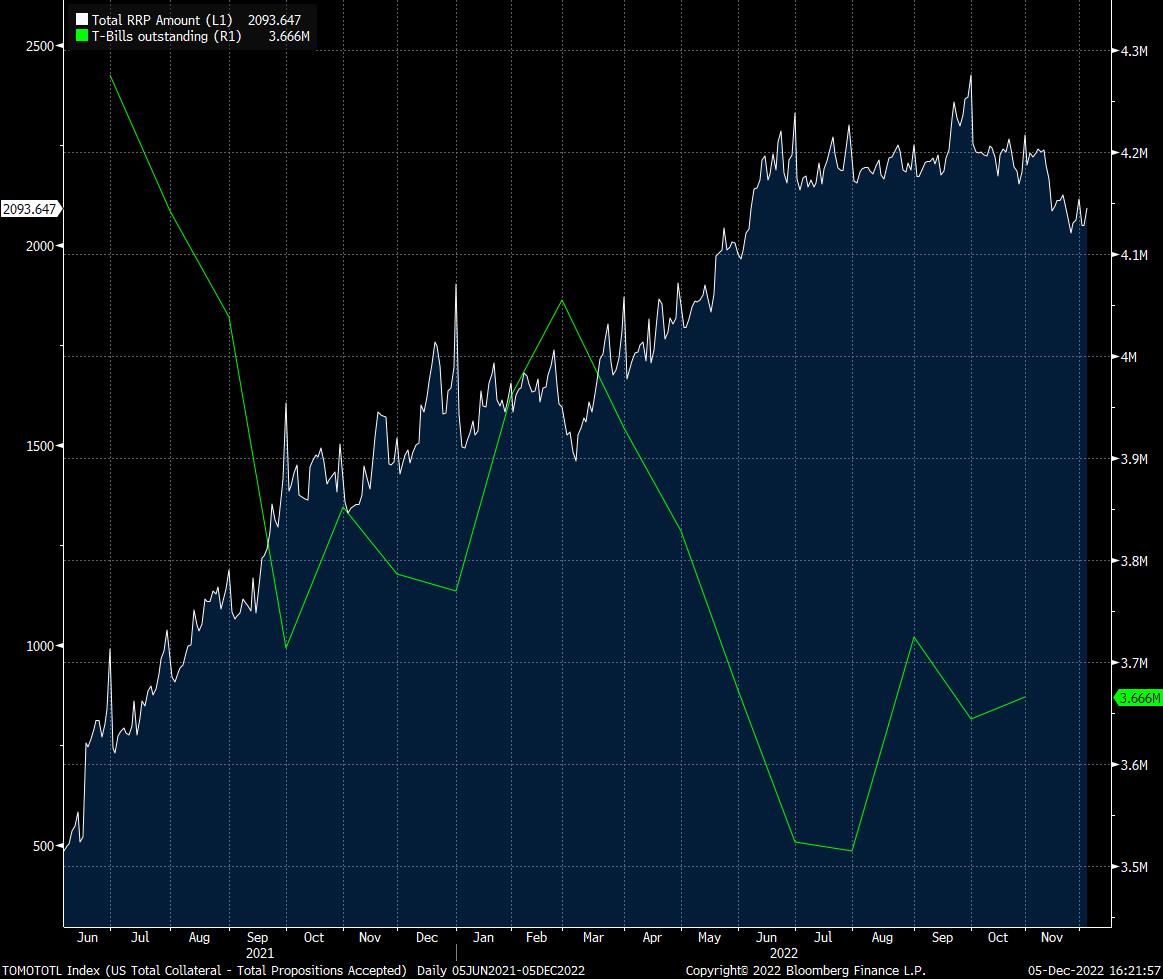

T-Bills Outstanding and RRP Daily Usage

Source: New York Fed and U.S. Treasury Department via Bloomberg

However, the larger money market funds – traditional buyers of the FHLBank System’s debt who also have access to RRP – gravitated either to overnight repo (via the RRP), or to securities offering yields closer to RRP equivalents. Although short-dated Agency debt levels (expressed as a spread to Secured Overnight Financing Rate, or “SOFR”) improved during this time, spreads between Agency discount notes (DNs) and T-Bills widened as non-RRP participants kept short-dated T-Bills well bid while money market funds held out for RRP equivalents. As money market funds moved cash out of Treasury and Agency fixed rate debt and into RRP repo, the daily size of RRP balances swelled from approximately $1.6 trillion per day in the first quarter to roughly $2.2 trillion per day in the third quarter. With the rebound in T-Bill issuance in the third quarter, and increased funding and issuance needs from the System, along with the full implementation of QT, RRP balances in the fourth quarter have started to decline to just over $2.0 trillion per day. Nevertheless, the amount of liquidity available from money-market investors provided the System with sufficient liquidity to fund growing advance balances.

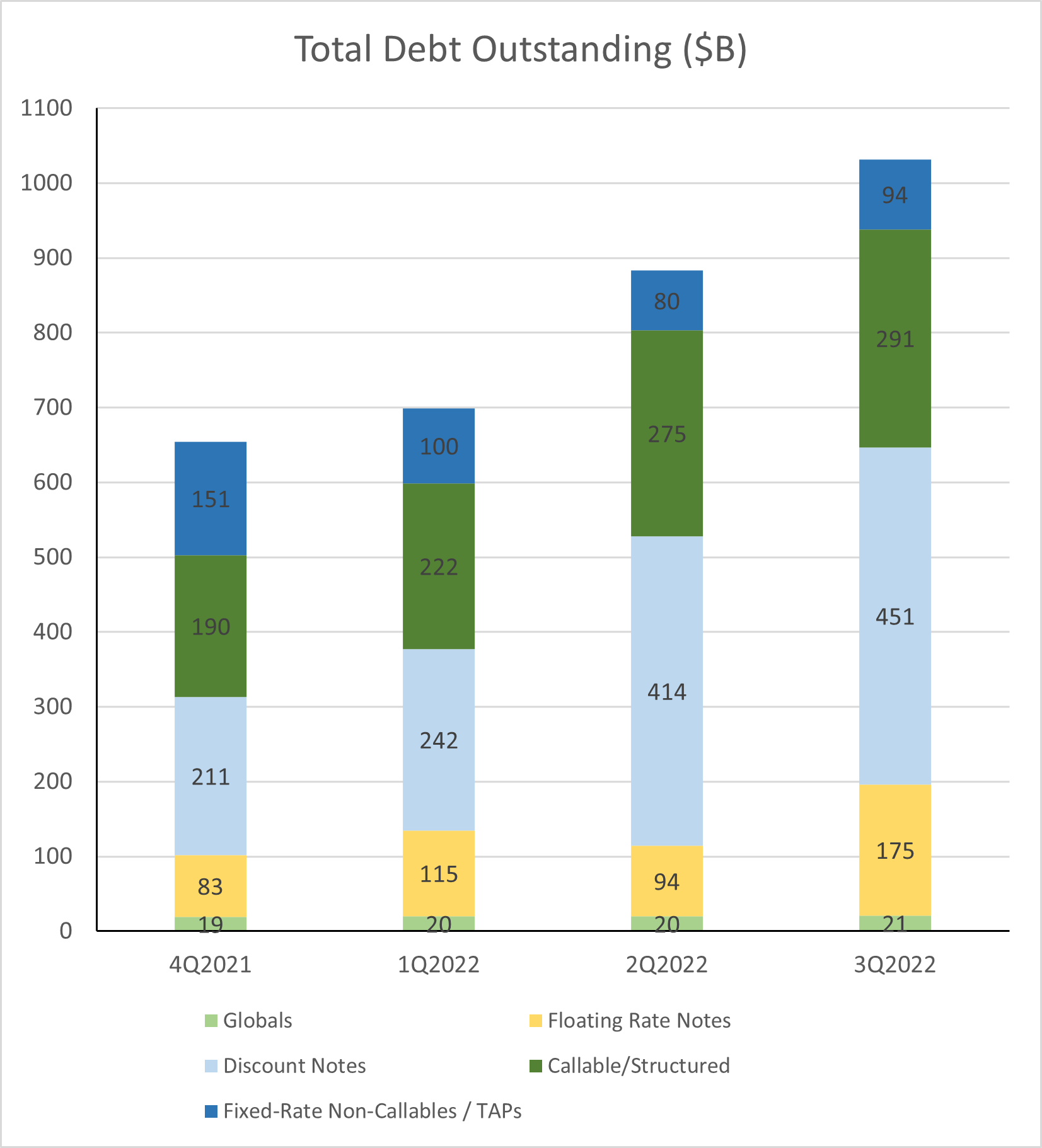

FHLBank System's Total Debt Outstanding (by quarter)

Source: FHLBanks Office of Finance

FHLBank funding in 2022 primarily consisted of short-term DNs SOFR floaters, and some fixed and swapped callable funding. During the first half of 2022, issuance was primarily very short-term as most advance demand was also short (less than three months). As monetary tightening took hold, and Treasury’s T-Bill issuance increased during the third quarter, the second half of the year saw steady advance demand across the FHLBank System as members needed to secure liquidity through advances. Opportunistic short-term funding became scarcer in the second half of the year as the System’s needs to fund advances picked up. To the extent that advance activity extended out the curve, the FHLBanks began issuing slightly longer debt to fund this activity.

The Bank and the System increased the use of SOFR floating rate notes (SOFR FRNs) in 2022’s third and fourth quarters, to help fund growth in advances and to meet investor demand for floating-rate assets given the Fed tightening environment. Swapped callable funding hedged to SOFR execution also provided funding at a cost benefit relative to alternative sources but was very limited in availability due to declining investor demand for the product.

Looking ahead, as visibility to the end of FOMC rate hikes increases, money market investors will likely extend their durations into longer maturity, higher yielding assets. However, their appetite will likely be constrained by possible redemptions in money market funds as the Fed’s quantitative tightening program drains reserves and creates more competition for short maturity investors/depositors. Usage of the Fed’s RRP program should continue to drop as money market funds find higher yielding alternatives to overnight repo and have greater certainty about the Fed policy outlook. We expect some disruption to this process as Treasury approaches their statutory debt limit, causing Treasury to initially limit T-Bill issuance to stay under the cap, then ramp up issuance quickly once Congress agrees on a new limit.

Disclaimer: The information contained in this article is for informational purposes only and should not be construed as a solicitation or offer or advice (financial, legal, or otherwise) by the Bank. Cited information is derived from sources believed by the Bank to be reliable, but the Bank does not warrant the accuracy or reasonableness of the information or of any assumptions or other information contained in this article, and the Bank expressly disclaims responsibility for any errors or omissions in computing or disseminating the information, and any use to which the information is put. The Bank further expressly disclaims any obligation to update or correct the information presented in this article.